lakewood sales tax online filing

To qualify for exemption an organization must complete an Application for Certificate of Exemption. If you choose to fill-out the form online you must PRINT the form.

Business Licensing Tax City Of Lakewood

License My Business Determine if your business needs to be licensed with the City and apply online.

. The City of Lakewood receives 1 of the 100 sales tax rate. The Lakewood Cultural Center and Performance Now Theatre Company present Americas Tony Award-winning musical 1776 March 18-April 3. Sales Tax Return Due Date.

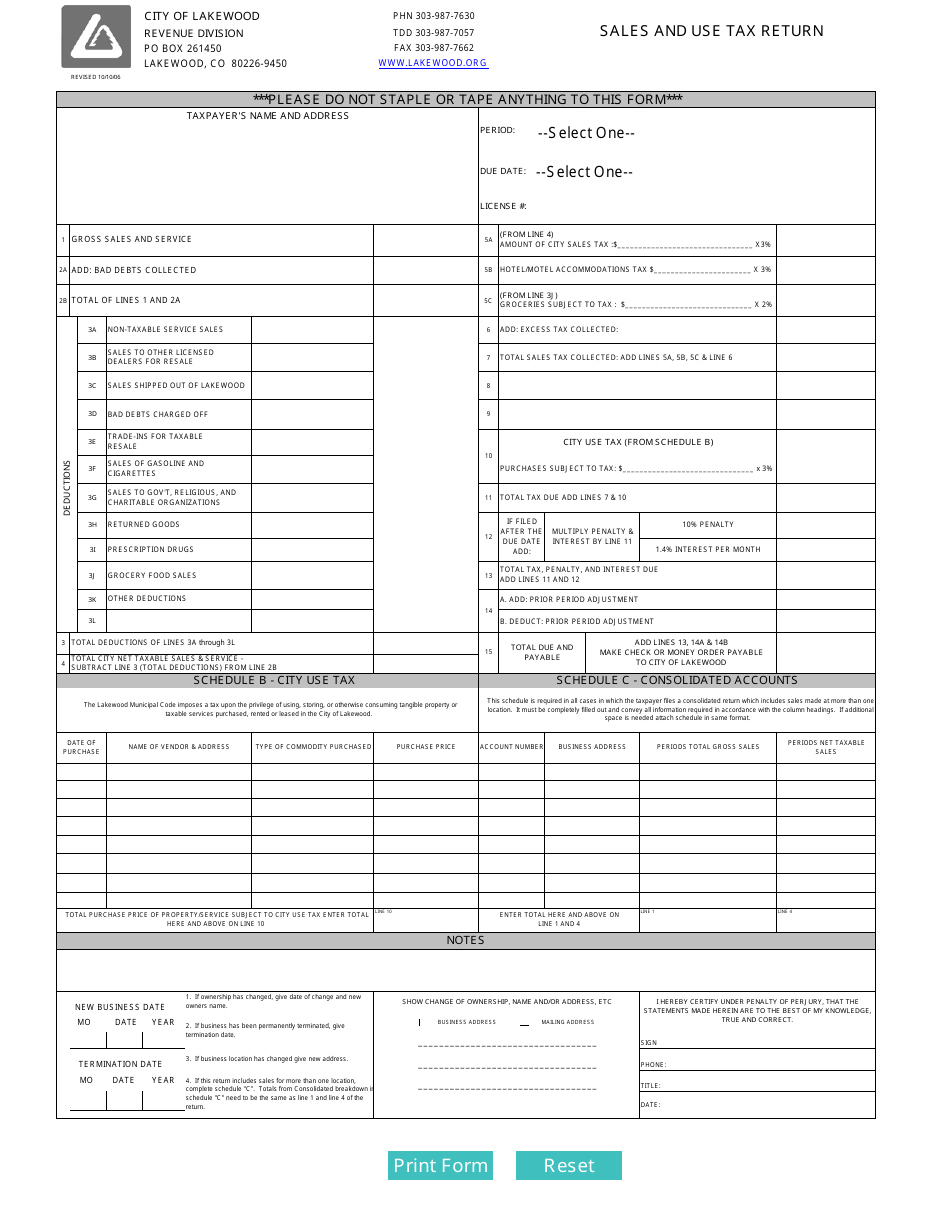

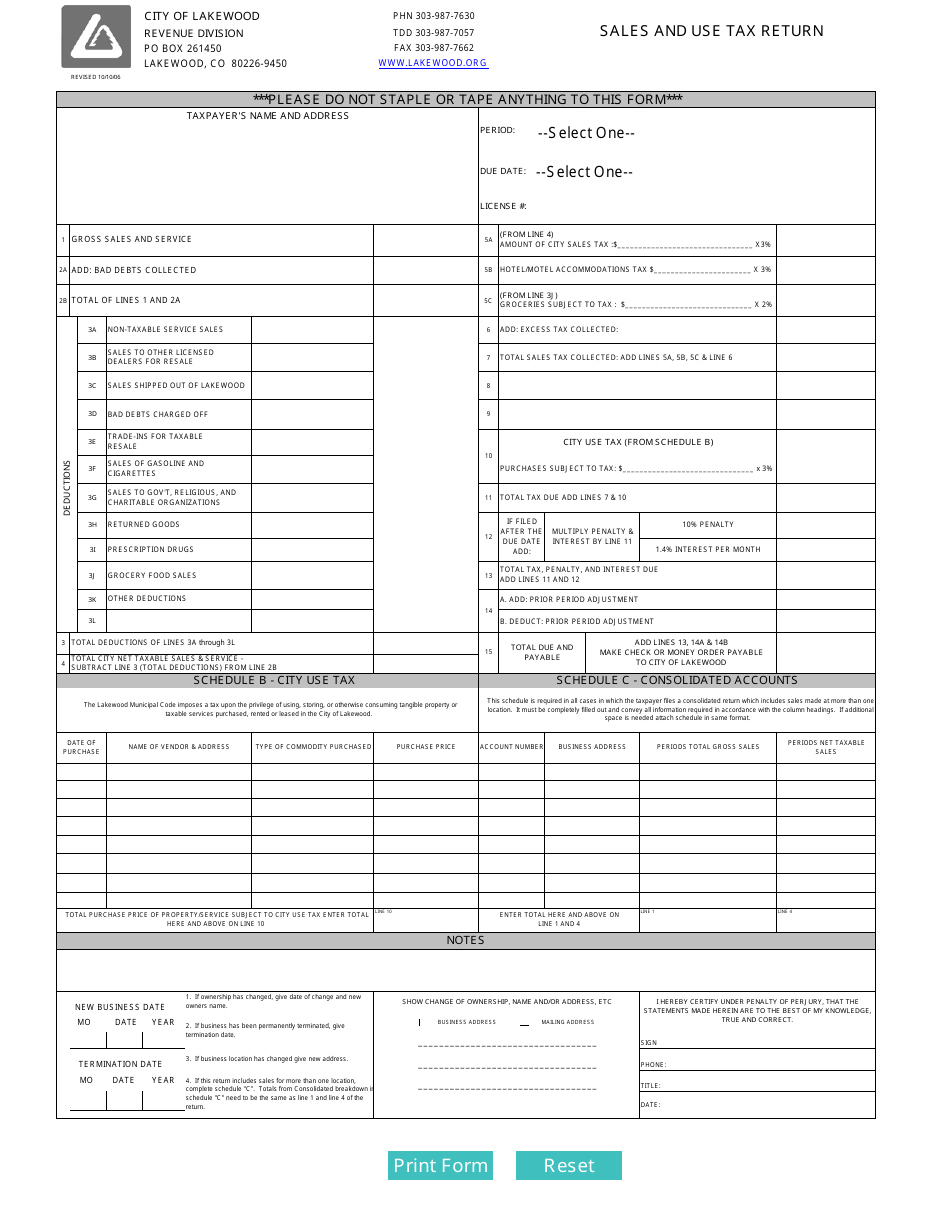

And MAIL the return to City of Lakewood Division of Tax. Filing of Sales Tax Returns Sales tax returns and payments shall be made monthly before the twentieth 20th day of the following month. Filing of Sales Tax Returns Sales tax returns and payments shall be made monthly before the twentieth 20th day of the following month.

Lakewood City Hall. 800 AM to 430 PM. ATTACH all appropriate W-2s 1099s and other Schedules.

FILE AND PAY SALES AND USE TAX ONLINE - 2018 and later. Businesses that pay more than 75000 per year in state sales tax. The City of Lakewood allows qualifying 501 c 3 organizations an exemption from Lakewood sales tax when they purchase goods and services for their regular charitable functions and activities.

If you are filing online the sales and use tax total due and payable must be paid online using an e-check or credit card. The ST3 sales and use tax rate of 050 is effective April 1 2017 bringing the total sales and use tax rate for Sound Transit to 140. Businesses with a sales tax liability of up to 15month or 180year.

Online Preparation of your 2021 City of Lakewood Income Tax Return To utilize the e-filee-pay system. Lakewood Economic Development makes sure your start-up existing or expanding business benefits from the Citys collaboration and support. The Finance Director may permit businesses whose monthly collected tax is less than three hundred dollars 300 to make returns and payments on a quarterly basis.

SIGN the printed form. For tax preparers CPAs and filing practitioners who manage multiple business accounts for multiple clients. Lakewood OH 44107 216 521-7580.

300 or more per month. The seminal event in American history blazes to vivid life in this most beautiful and unconventional. Businesses with a sales tax liability between 15-300 per month.

If you have more than one business location you must file a separate return in Revenue Online for each location. We register file read lettersemails resolve notices. Download the City of Lakewoods Interactive 2020 L.

The following links change the page section. Create a Tax Preparer Account We cover more than 300 local jurisdictions across Alabama California Colorado Kansas Louisiana and Texas. Monthly returns are due the 20th day of month following reporting period.

On April 2 2019 the voters of Grand Junction authorized a 05 increase in the sales and use tax rate for the City of Grand Junction. The Finance Director may permit businesses whose monthly collected tax is less than three hundred dollars 300 to make returns and payments on a quarterly basis. Witness the birth of a nation as our forefathers struggle to craft the Declaration of Independence.

Ad Sales Tax Experts manage State compliance and bureaucracy on your behalf in all states. Returns can be accessed online at Lakewood. 800 AM to 430 PM.

Return and payment due on or before January 20th each year. Sales and Use Tax Returns - 2017 and earlier. Ad Taxfyle solves all of your tax needs by connecting you w a US-based licensed CPA pro.

Returns can be accessed online at Lakewood. Plug In To The Worlds Largest On-Demand Domestic Accounting Workforce. Input your social security number or the primarys social security number in the case of a joint account and create a PIN number by clicking on the Dont have a PIN link next to the log in screens PIN field.

For additional e-file options for businesses with more than one location see Using an. After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. If the 20th falls on a holiday or weekend the due date is the next business day.

Community government and strategic partnerships allow Lakewood to provide your business with all the information necessary to succeed and thrive in our community. To avoid this fee please file online through Xpress Bill Pay as detailed above. Sales and use tax returns are due on the 20th day of each month following the end of the filing period.

Lakewood OH 44107 216 521-7580. Manage your tax account online - file and pay returns update account information and correspond with the Lakewood Revenue Division. There are a few ways to e-file sales tax returns.

Return and payment due on or before the 20th of the month following the end of each quarter. Your browser appears to have cookies disabled. Sales tax returns must be filed monthly.

The new 325 sales and use tax rate becomes effective for transactions occurring on or after January 1 2020This means the new sales and use tax rate will first be reported on the tax returns due on February 20 2020 or later. Cookies are required to use this site. The Sales and Use Tax Return is generally due on the 20th of the month following the close of the reporting period.

The breakdown of the 100 sales tax rate is as follows.

13 Options For Free Online Tax Filing Filing Taxes Online Taxes Free Tax Filing

Five Things To Know For This Year S Tax Season Wane 15

Business Internetmarketing Kindlebooks Marketing Marketingadvice Marketingtips Selfhelp Hvac Company Internet Marketing Free Internet Marketing

How To Organize Your Receipts For Tax Time Tax Time Small Business Tax Business Tax

Where Do My Taxes Go H R Block Business Leader Consumer Math Financial Planning

Fast Payday Loans All Credits Are Welcomed Payday Loans Payday Cash Loans

The Smarter Way To File Your Taxes Infographic Filing Taxes Tax Refund Infographic

Business Licensing Tax City Of Lakewood

File Sales Tax Online Department Of Revenue Taxation

Business Licensing Tax City Of Lakewood

File Sales Tax Online Department Of Revenue Taxation

Top Metros Of 2013 The Connected City Site Selection Online Newark City Commercial Real Estate Ny City

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca Business Tax Small Business Tax Business Tax Deductions

File Sales Tax Online Department Of Revenue Taxation

File Sales Tax Online Department Of Revenue Taxation

2006 City Of Lakewood Sales And Use Tax Return Form Download Fillable Pdf Templateroller

Will Ohio S Tax Filing Deadline Be Postponed To May 17 To Match The New Irs Deadline Cleveland Com

Pin By Experto Tax Service On Experto Tax Service Small Business Online Small Business Online Business

What Can You Write Off On Your Taxes From Your Direct Sales Business Taxtime Directsales Savemoney Business Tax Small Business Tax Business Finance